August 22, 2016 Can money really buy happiness?

Wouldn’t life be so much easier if we just had a little bit more money?

I’m sure it’s a question we’ve all asked ourselves now and again.

It’s easy to fall into the cycle of thinking that “if only we could get that better-paying job” or “get that pay rise” we’d been angling for, then we’d definitely be happier.

We then think that with all this extra money, we could afford the bigger house, the new car and all the other stuff we’ve been conditioned to feel we need, all to make us happy.

It’s easy to get caught up in the idea that more money could solve all our problems.

Surrounded by relentless advertising, product placement and a 24-hour connected world constantly bombarding us with messages about how much better our lives could be if we had A, B and C, it’s enough to drive anyone a little mad.

But let’s step back a little, even for a moment.

Should we just accept the idea that having more money would bring us happiness?

When all is said and done, can money really buy happiness?

Money does buy happiness – to a point

The simple answer, according to the research I’ve been reading, is yes, money can indeed buy happiness – but only to a point.

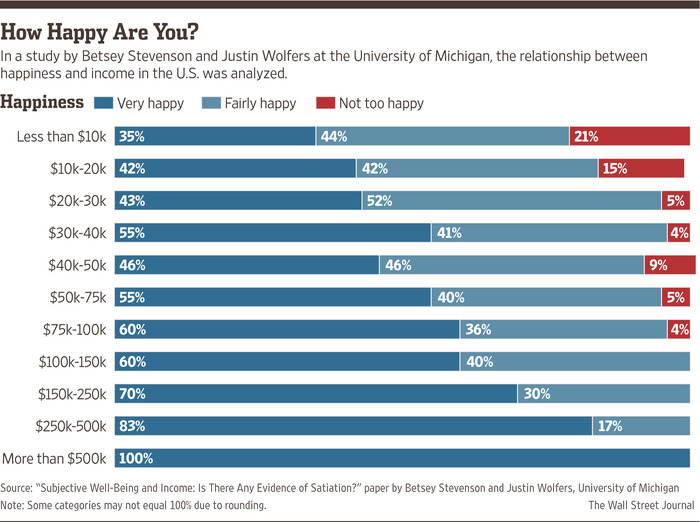

Nobel Economics Laureates, Americans Angus Deaton and Daniel Kahneman released their Nobel-winning study in 2015 looking into the very topic of whether money can buy our happiness, or what they call our “emotional well-being”.

The study was extensive and the key the findings confirm what most of us would probably see as common sense.

You can “buy” your happiness if you’re on a high salary because you have enough to cover all your essential and unavoidable expenses. You also have enough stashed away for a rainy day and crucially, you’ve got enough in disposable income to actually get out there and enjoy your life.

Of course, it makes sense (and the study supports this) that those who struggle to make ends meet would be considerably less stressed if their incomes were higher.

Imagine how immense the stress is if you’re living from payslip to payslip? What if something unexpected happens and you need cash to sort it out?

So at what point, then, does money stop making us happy?

Deaton and Kahneman’s study concluded that if you’re American, you can buy your happiness or “emotional well-being” if you earn an annual salary of $US 75,000 (about $98,000 in Aussie dollars). According to them, this was the ceiling figure where you could pay your way through life and still have enough for creature comforts.

At the study’s release, people were really fixated on this figure.

Their study even made it into popular culture, scoring a mention on an episode of Orange is the New Black. But the dollar amount wasn’t all that relevant. The study’s more important take-home message was that above a certain amount of money you earn, there’s not much that it can do to raise your happiness levels.

In a nutshell – after a certain income threshold, your happiness or emotional well-being will plateau.

Happiness doesn’t come in the form of stuff

Have you upgraded your mobile for the third time in as many years?

Maybe you think it’s time for a new tablet?

Perhaps you’re eyeing off a new car?

You might be better off saving your dollars because research shows that acquiring new stuff won’t make you happy in the long term.

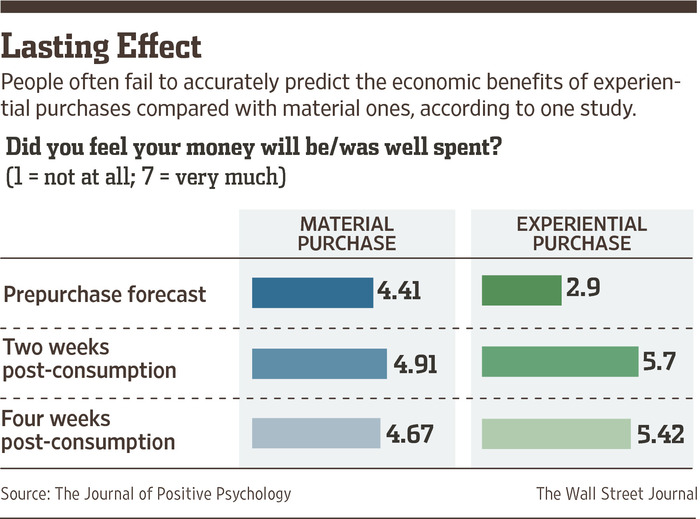

One of the more influential studies to come out of the US about the money vs happiness debate is from San Francisco State University.

The study led by researcher, Prof. Ryan Howell revealed people opt to buy material goods because they feel buying tangible goods is better value for money over paying for things like holidays or concert tickets. This was especially true when people were tightening their belts. They felt their money was better spent on buying things rather than experiences.

Interestingly, the study showed the same people looked back at their purchases later with regret.

They realised that experiences – rather than stuff – provided them greater longer lasting satisfaction and ultimately, better value.

The main reason for this?

Some of us think that spending money on experiences such as holidays, dining out, concerts, theatre, etc. is perhaps, wasteful because they seemingly offer only temporary happiness. We then reason that when we buy things instead, they’re always there and we imagine ourselves gaining greater value from their repeated use.

What we don’t factor in is that eventually, we become accustomed to our things.

The thrill of buying a much-wanted item, like a new phone or an expensive handbag, quickly wears off and the sheen of having new things gives way to the fact that ultimately, the things we desire and buy are just things. Things that will likely end up in the bin, too.

Even if we don’t think that it is money well spent to go on an expensive holiday, it’s a rare person who thinks, “Man, I wish I hadn’t just gone to Peru and seen Machu Pichu!”

And lastly, it’s so easy to get caught up in the trap that is trying to ‘Keep up with the Joneses’.

You just have to scroll through your Facebook and Instagram feed to see why people can get down and out about what they’re missing out on, while everyone around them seems to be living it up.

More importantly, we often share our experiences with others and as such, gives us a greater sense of connection with those closest to us. They help to form a larger sense of ourselves. All these ingredients help to foster our sense of emotional fulfilment and ultimately, our happiness.

To get more happiness from your money, it matters how you spend it

Knowing that it’s experiences over material goods that make us happy, what kind of things are worth spending your hard-earned money on?

Get away from it all

Maybe you’re the type of person who feels that it’s just never a good time to take time off work.

You’re connected to work via phone and email 24/7. It’s a pretty stressful existence. So going on holiday is probably exactly what the doctor ordered.

With workplaces now offering employees the option of cashing out their annual leave, it almost looks like we’re being discouraged to take a break. But doing so will go a great way to bolster your happiness levels.

Take the time to go on holiday or a short escape with your family and friends.

Regular readers of my blog will be aware that I did just that earlier this year. My family and I with our good friends holidayed in Noosa for a week and had a great time creating lots of memories, bonding and enjoying each other’s company.

Appreciate what you have, rather than long for what you don’t

If buying new things doesn’t guarantee your happiness because you just get used to your stuff, then think twice about what you choose to buy.

I’m not advocating giving up on shopping altogether as that wouldn’t be practical (or much fun!) but a slight change in your thinking can save you money and make you happier.

It’s too easy to replace perfectly serviceable things.

For example, we’re conditioned to believe that we need to replace our mobiles every two years when the contract expires, even if our phones are in perfectly working order. We feel we need to upgrade to a bigger TV or laptop with a faster processor.

Instead, keep what you have if it works. Spend your money on what is likely to allow you and your friends and family to enjoy your lives.

Donate your money

If you’re looking for ways your money can make a positive contribution, then donate to charities.

You can choose charities or causes that you feel strong about and involve yourself.

Donating money delivers a definite feel good factor for you, the donor, and tangible benefits for the recipient. Everyone wins.

(Plus all donations above $2 are tax deductible).

Buy some time

In some cases, the saying “time is money” might well be true.

Consider if there are any jobs or chores you can outsource around the house in order to get back some valuable time with friends and family? These can be things such as hiring a gardener or a cleaner.

The idea of “buying time” can even be extended when considering where you want to live. For example, it might be tempting to buy the big designer house with a pool in the outer suburbs. But would it be really worth it if it meant you could be potentially be spending hours in traffic to get to and from work, instead of spending time with your family?

Pay off your debts

Australians love their credit cards.

In fact, according to ASIC, each credit card holder owes about $4300. That’s a lot of dough.

So, researchers tell us that if you want to use your money effectively to raise your happiness levels, pay off your debts first.

Of course, it’s important to build your savings. However, the research shows that regardless of income levels, attaining happiness is achieved when you’re debt-free first.

Making Change

One thing I have found true in life is that the more family income we have the harder we work for it and the more we spend.

Changing this paradigm for me has been difficult. It was starting a family that made me take a good hard look at my relationship with money.

If you’re thinking of changing your money behaviours, take stock of where you are now. Make a plan of what you want to achieve with your money in the short and long term.

You could start by jotting down some goals.

You can talk to your adviser about how to do this as well.

In the end, the research points to what I think many of already know but might not practice.

Money can buy you happiness, as long as you’re spending it ‘right’.

I you want to chat more about getting more from your money, email me or schedule a call below:

Chris

Posted at 22:36h, 24 AugustReally interesting article Michael. Would love to see that first study done in Australia and see what the numbers are!

Corey

Posted at 15:33h, 28 MarchNicely put, Thanks a lot.

Cialis

Posted at 02:26h, 28 AprilWith thanks! Great information!

Flo

Posted at 19:37h, 26 JuneI have been exploring for a little bit for any high quality articles or blog posts on money and happiness.

Exploring in Yahoo I ultimately stumbled upon this web site and discovered just what I needed.

Lillian

Posted at 09:07h, 29 AugustI am really impressed with your writing skills as well as with the

layout on your weblog. Keep up the nice quality writing, it’s rare to see a nice blog like this

onee today.

Help your bank balance survive Christmas - Orange Wealth

Posted at 09:26h, 27 September[…] also tend to make a lot of emotional purchases this time of year, made all the more easy with having credit cards on hand to simply tap away […]